Most business leaders have already cut down all discretionary spending. Ad spends have been reduced drastically and everything that is non-essential, which means it doesn’t contribute to sales, is being evaluated constantly. But after that has been done, is there another way to look at company costs and further reduce spends that maybe weighing your firm down? There are several methods and matrices by which CEOs can evaluate the best business management strategies.

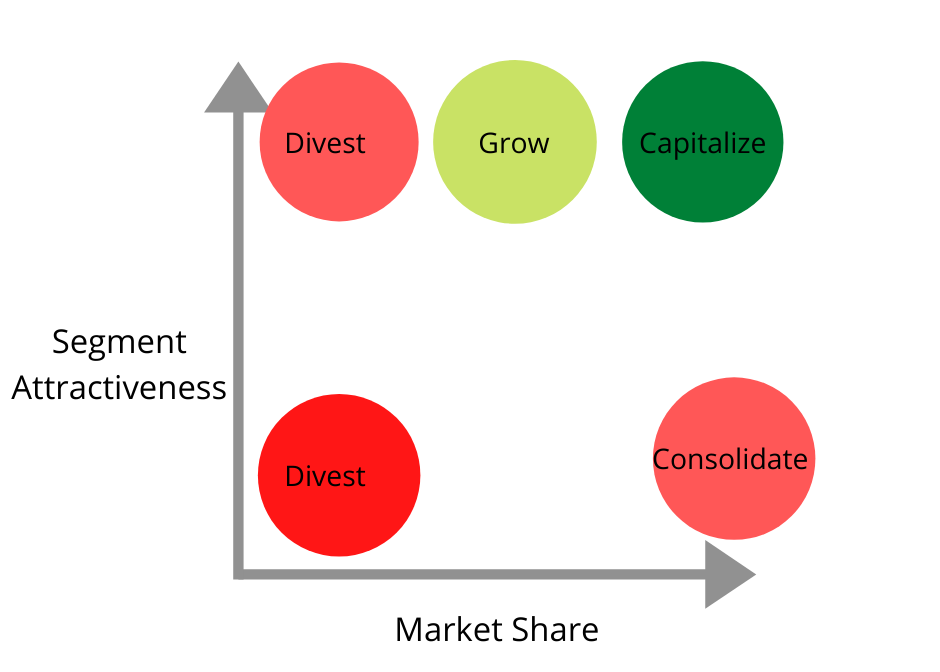

The first among these is to plot all your businesses in a 2×2 matrix of segment attractiveness vs relative market share. Thus different verticals or segments could be categorized in broadly five different categories – a) Low segment attractiveness with high market share. Such businesses should be consolidated. b) Low segment attractiveness with lagging market share – For these you should consider divestment c) High Segment attractiveness with lagging market share – Here you could take selective bets or divest d) Medium segment attractiveness with mid-level market share – Here should stay present only if you see a way to grow the business to full potential e) High segment attractiveness with leading market share – These are the segments that should be capitalized.

The process of capitalizing the most promising business might need profitable product refinement or innovation. The next step would be to create a clear structure for executing the new finalized strategy across the organization. Optimized investments and operational efficiency will yield the best results. Finally, define the new portfolio based on current and new businesses, outline the most likely prospects and the best funding models.

The process of capitalizing the most promising business might need profitable product refinement or innovation. The next step would be to create a clear structure for executing the new finalized strategy across the organization. Optimized investments and operational efficiency will yield the best results. Finally, define the new portfolio based on current and new businesses, outline the most likely prospects and the best funding models.

In case one is not going with the above strategy but instead trying to manage costs, there are a few things to be cognizant of. While cost cutting is essential during a pandemic, business heads must be careful not to make the business vulnerable to opportunistic competition. It is essential for firms to frequently revisit all short term and long term expenses and revise them as necessary. A break-even analysis must be run in order to accommodate multiple scenarios, so that you can fully account for any changes in the expenses the firm may incur.

In order to prioritize cash flow, one could look at restructuring payroll, and moving some positions to part-time. The option of “working from home” if possible is not only beneficial from a safety standpoint, but can also reduce office expenses, travel expenditure and other utilities that are required when employees come to office. Hiring could be delayed till the crisis has resolved or demand has picked up and any non-essential projects could be post-postponed.

Your team could also review all current contracts and subscriptions and opt out of ones that are not key to business. Managing suppliers is key at this juncture, as you can leverage the long term relationships in order to renegotiate contracts or get better prices and terms.

The Covid-19 pandemic will follow the pattern of a broad crisis, which means that the impact will be deep and the recovery will take a long time. So while implementing cost cutting measures, one has to ensure that these are sustainable over a long period.

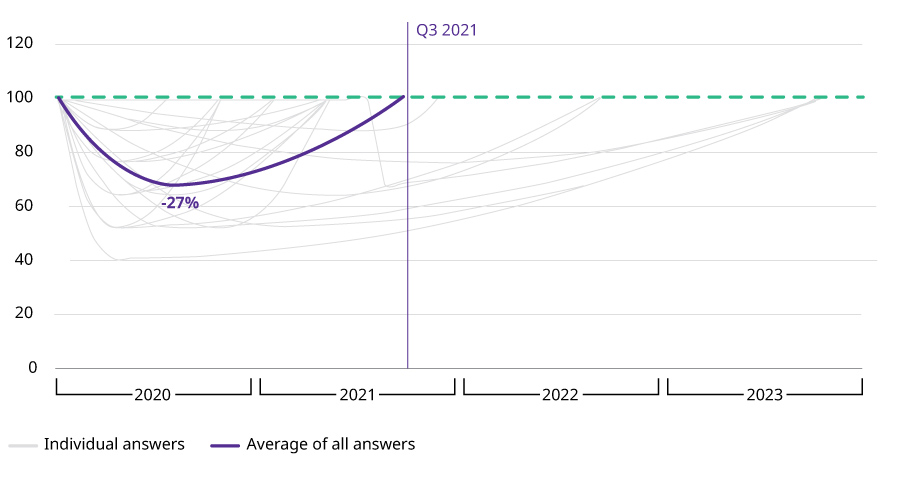

Expected Revenue

Source: Survey of executives with globally-acting manufacturing firms, Oliver Wyman analysis

Source: Survey of executives with globally-acting manufacturing firms, Oliver Wyman analysis

Firms which have responded to the previous financial crisis with planned performance improvement, have significantly done better than those who only adopted cost cutting measures. As per the strategy laid out in the beginning of this article, real savings and better performance will come by focusing on sourcing, production optimization, reduction of overheads and new pricing mechanisms. Transformation programs can aid in optimizing the business portfolio, in M&A and restructuring.

Short term responses regarding supply chain continuity, furloughs and other cost reductions have to be monitored and adjusted as required. In a crisis situation, the urgent will tend to get more priority than the important and business leaders will constantly have to re-evaluate what to focus on. Having separate teams that can work on short-term cures and long-term sustainable solutions can be helpful.